04.02.2026

The main purpose of insuring our cars is to protect ourselves and other participants in possible traffic accidents financially. And if you visit a service station and look at their prices, the idea that the cost of a car insurance policy is very high simply disappears. However, not every car owner understands how car insurance is calculated. In addition, not everyone knows what it depends on and how exactly you can insure your car. So let's break it down.

The main types of car insurance

The cost of car insurance depends on what type of insurance you are interested in. And besides the mandatory policy, there are other options.

Car insurance

The price of car insurance will primarily depend on the type of insurance. And, of course, every vehicle owner will be interested in how much car insurance costs. After all, this policy is mandatory. Its purpose is to cover damage to the health, life, and property of victims in traffic accidents. However, the person responsible for the accident will have to pay for the repair of their vehicle themselves.

When talking about the cost of car insurance, it is important to mention the available liability limits. These are as follows:

-

up to UAH 250,000 for property damage;

-

up to UAH 500,000 for damage to health or life.

In any case, the cost of car insurance per year will definitely be lower than these amounts.

CASCO

Only those who want to purchase this type of insurance need to find out how much it costs. This type of insurance is not mandatory. Its purpose is to cover the costs of repairing your car in the event of an accident, natural disaster, or third-party damage. The company will reimburse you regardless of who is at fault for the accident.

Green Card

If you plan to travel outside the country, you will need this type of policy. It can be taken out for a period of 15 days or more. The cost will depend on where you are going, what vehicle you are traveling in, and how long you will be there. This type of insurance covers damage to third parties.

Сar insurance expansion

This is a so-called additional motor insurance in a more extended format. It provides for an increase in the insurance amount, which, if necessary, will allow you to protect yourself from unnecessary expenses. For example, you can increase the insurance amount to over UAH 1 million.

Comparison of the main types of motor insurance

|

Criterion |

Car insurance |

CASCO |

Car insurance expansion |

Green Card |

|

Mandatory |

Yes |

No |

No |

Yes (for traveling abroad) |

|

Protection of your own car |

No |

Yes |

No |

No |

|

Protection of third parties |

Yes |

No |

Yes |

Yes |

|

Cost |

Law |

High |

Medium |

Medium/High |

How to get car insurance: step-by-step instructions

Car owners are interested not only in how much car insurance costs, but also in how to get it. It's very simple. Just visit the KIRINS website, because we offer the most favorable terms. Then follow a few simple steps:

-

determine what kind of insurance you need;

-

prepare the necessary documents (tax ID number, passport or driver's license, vehicle registration certificate);

-

take out a policy;

-

check the data in the MTIBU database.

All this will not take much time, but it will make every trip on the road safer.

What determines the cost of car insurance?

Several factors are taken into account when calculating the cost of car insurance, namely:

-

type of vehicle;

-

engine size;

-

place of registration;

-

driver's age and experience;

-

presence or absence of insurance claims in the past.

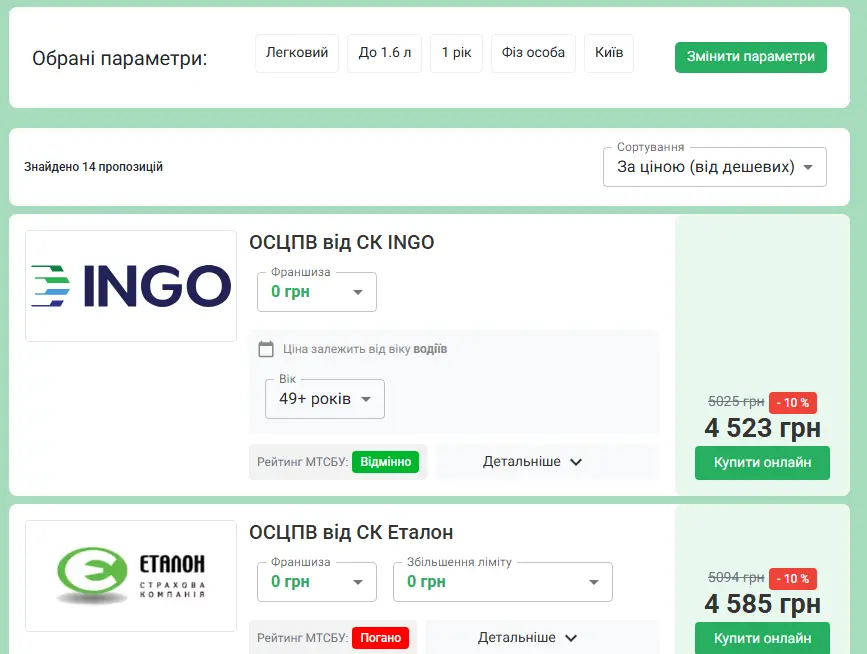

Let's calculate the cost of car insurance using the calculator on our website. For example, we have a passenger car in Kyiv with a 1.6-liter engine. Its owner is an individual, and insurance is required for one year. Accordingly, we have the following results:

As we can see, this calculation of car insurance costs allows us to choose from 14 options, with annual costs starting at 4,523 UAH. It is important to understand that car insurance is most expensive in Kyiv. The reason is that there is a heavy traffic load here, and the accident statistics are quite high. Therefore, for comparison, let's do the same calculation for another city.

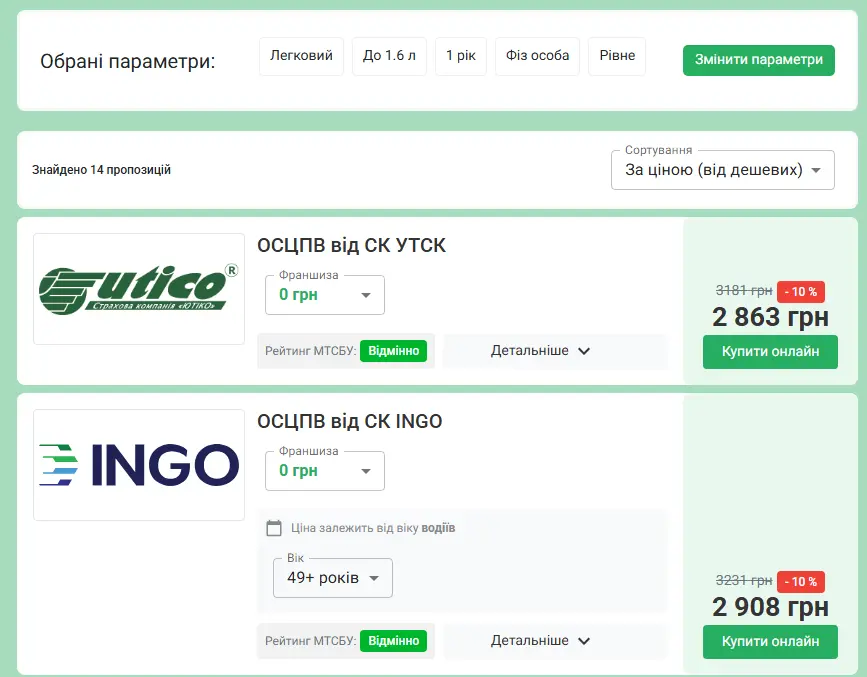

As we can see, if we calculate the cost of motor vehicle insurance for the city of Rivne, the price will start at 2,863 UAH.

Useful tips for drivers in 2026 for car insurance

Calculating the cost of car insurance and choosing the best option for yourself is only half the battle. There are several other important points to consider, namely:

-

you need to regularly check the validity of the policy in the MTIBU database;

-

you need to carefully read the terms of the contract before signing, especially those relating to exceptions;

-

you should keep an electronic copy of the policy;

-

you should notify the insurance company immediately in the event of an accident.

In general, car insurance is a combination of responsibility before the law and before yourself. This annual payment will protect you from payments to third parties in the event of an accident. And optional policies will protect the car owner from financial risks. The main thing here is to choose the most advantageous option for yourself. And where can you do that? Of course, on our website KIRINS.