A motorcycle cannot be compared to a car and simply called a means of transportation. After all, it is a lifestyle, and for many, even a childhood dream that has finally come true. However, dreams are dreams, but you still need insurance for your motorcycle. This type of transport is classified as high risk. And repairs are quite expensive, especially for exclusive or powerful models. Therefore, motorcycle insurance is not only a matter of complying with the law, but also a prerequisite for responsible and safe travel.

Why should you insure your motorcycle with KIRINS?

Not all insurance companies are eager to offer such services. After all, this type of transport can hardly be called safe, and its operation is specific. However, KIRINS is an exception, offering motorcycle insurance on the most favorable terms.

We have various insurance options.

-

OSAGO (motor third party liability insurance). This is compulsory insurance for motorcycles, which every road user must have.

-

CASCO for motorcycles. This is an additional policy, and its purpose is to protect the road user from natural disasters, illegal actions, and damage.

You can choose between compulsory insurance or CASCO based on how often you use your motorcycle, its cost, and the desired level of protection.

For how long can I take out insurance?

The price of motorcycle insurance generally depends on the term. And to the delight of motorcycle enthusiasts, you can take out a policy for two periods — six months or one year. This allows you to choose the insurance that suits your needs.

Most often, people choose the right solution for the following purposes:

-

motorcycle season — 6-month policy;

-

the whole year for constant use.

To find out the price of motorcycle insurance, use the online calculator on our website.

What determines the cost of motorcycle insurance?

If it is motorcycle insurance, its price will be calculated individually based on several important parameters. The following factors affect the final amount:

-

engine capacity (up to 300 cm³ or more);

-

region where the vehicle is registered;

-

policy term;

-

type of ownership.

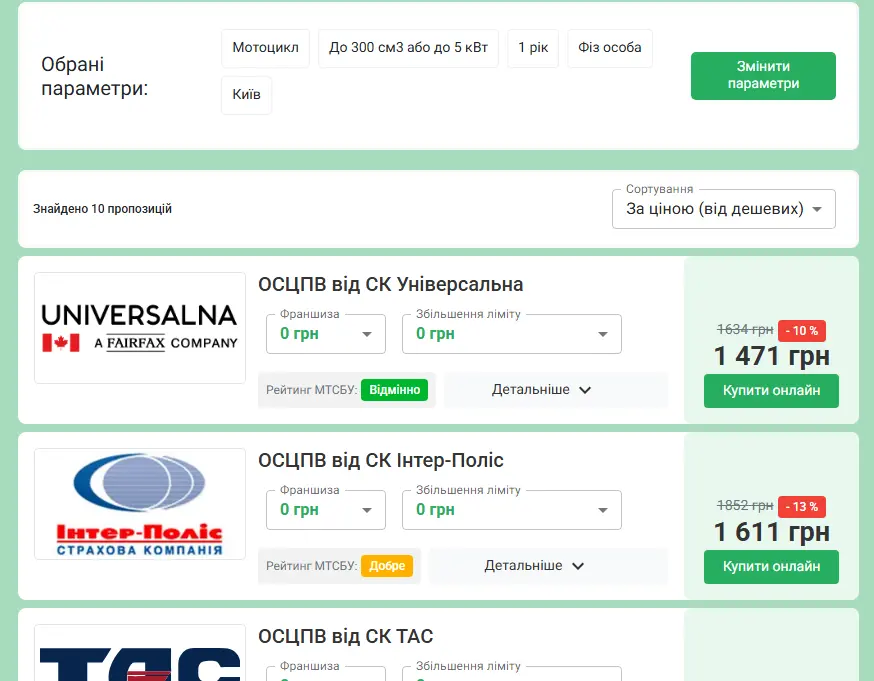

Therefore, the price of motorcycle insurance can only be determined after calculating a specific case. For example, the cost of insurance for a motorcycle up to 300 cm³ for 1 year in Kyiv for an individual will start at UAH 1,471.

What is important to know about motorcycle insurance?

Before purchasing a motorcycle insurance policy, the price of which will suit every motorcycle enthusiast, you need to learn a little more about it. In particular, you should understand the following:

-

according to Ukrainian law, motorcycle insurance is mandatory;

-

an electronic policy has the same legal force as a paper one;

-

the policy is valid throughout the country;

-

in the event of an accident, the insurance company will compensate the injured third parties.

So, in any case, the policy will allow you to feel more confident on the road.

Advantages of motorcycle insurance at KIRINS

We make insurance not only reliable and profitable, but also convenient and comfortable for the client. Pleasant bonuses and convenient service help us achieve this. Each customer receives the following:

-

automatic reminders that the policy is about to expire;

-

attractive discounts, bonus offers, and promotions;

-

round-the-clock support;

-

quick online registration without the need to visit the office.

This allows you to save time on registration and provides comfortable conditions for insurance.